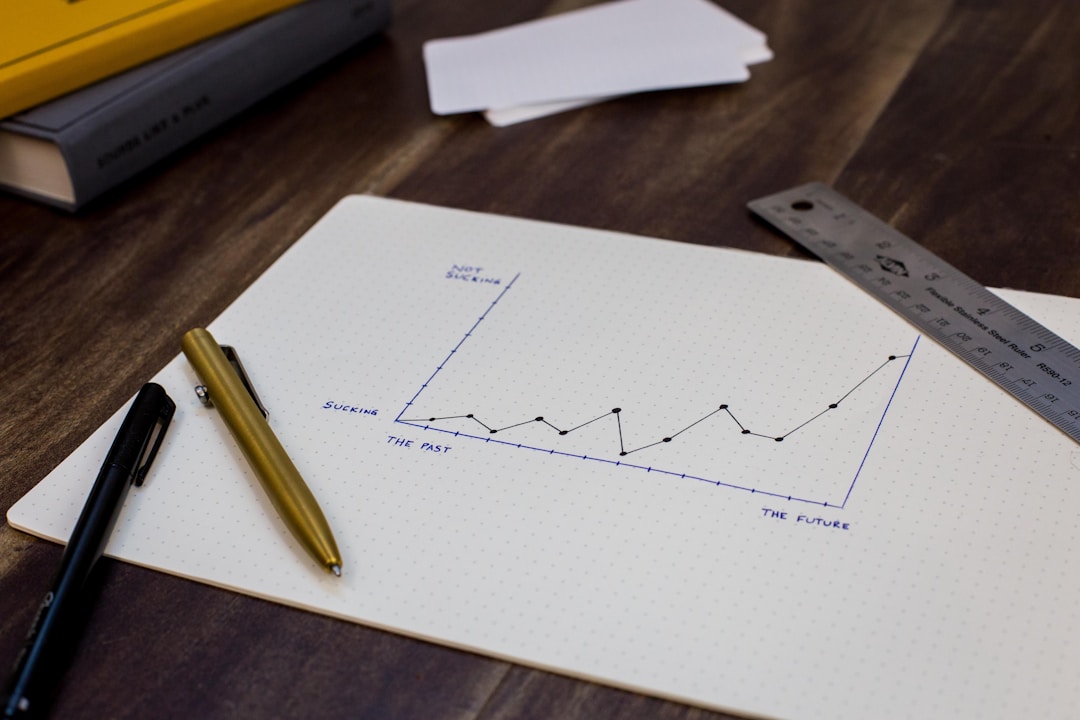

Line graphs offer insights into time-based variables. Data represented with the unique feature of time can be leveraged to understand how business, investments, and many other facets of life change over time. Virtually anything can be represented through the ongoing march of time, and with the help of a line graph, deriving insights and making sense of patterns that persist across the space of time is simple and can help you make better decisions in all walks of life.

Data represented in a line graph is often related to financial services or sales of some variety. This is because businesses and investors are obsessed with the ability to extract information and patterns from the history of a commodity’s price movement or a particular sales strategy employed in the past. Indeed, the past is the key feature of a line graph’s power of interpretation. Reason suggests to data users that past performance can indicate how something might behave in the future, although it can’t guarantee any kind of outcome no matter the strength of the insights built from the data. Researchers and data scientists alike work tirelessly to construct algorithmic representations of a vast network of time-sensitive data points in order to work out how future performance may be impacted by new features of the marketplace.

Continue reading to learn more about the strongest use cases for line graph representations of key data points.

Line graphs offer predictive power for stock traders.

A line graph can help a business management team make smarter purchasing and sales decisions throughout the supply chain, but it’s perhaps most recognizable in the stock-trading realm. As a visualization tool, line graphs are seen on every screen that broadcasts midday stock-trading information and advice. Investors follow the constant movement of the Nasdaq or S&P 500 charts and make decisions based upon the momentum and countless other factors.

In the modern incarnation of stock trading, retail traders have grown increasingly closer to the approaches and technical analysis techniques used by institutional investors and hedge-fund management firms. In these visualizations of market metrics, line graph operations are a key factor in the analytics employed. Mapping the progress of individual stocks against the aggregate index and many other customized linear graphing products is the keystone by which momentum trading and other approaches to the market are gauged.

With the help of line graphs, investors can overlay other trends that happen along with the same time pattern, building a comprehensive understanding of the factors that can influence price and signal a change of direction, consolidation of support at a new level, and much more.

Line graphing is crucial for measuring output in the manufacturing space as well.

In factories all across the world, utilizing a line graph to understand continuous output across the span of time is an ingrained feature. With the upgrade to Industry 4.0 reimagining the efficiency of the manufacturing space, the use of data analysis products is more prevalent than ever before. Within factories everywhere, relayed data is built into tables and sheets in real-time, allowing for constant monitoring of hourly, daily, and weekly output across all interior sectors of the facility.

Understanding midstream output goals and monitoring progress toward them in real-time is an advantage that wasn’t available in any meaningful way until just recently. Today, brands are able to maintain an accurate accounting of virtually every move that happens within their four walls. This prowess in building and understanding data is thanks to the analysis tools that collate data and bring it all to bear with the unrivaled analysis tool that is the line graph.